Fidelity Target-Date Funds Take $100k+ in Returns

Hiding in Plain Sight: Expensive Defaulted Target-Date Funds

Below are two client examples. Each Fidelity 401(k) Target Date Fund ranged in internal fees from 0.55% to 1.00% (e.g., expense ratios). Instead of clients using an index fund constructed portfolio a 1/10 to 1/5 of the cost. Many intelligent clients default into costly target date funds within their 401(k)s for convenience, but most are shocked once they understand how much fees they are paying.

In 2019, Fidelity held 21% of all target date assets. Second to Vanguard (an exception to this post). T. Rowe Price, American Funds, TIAA-CREF, and J.P. Morgan all have Target Date funds costing 401(k) participants more than they might know.

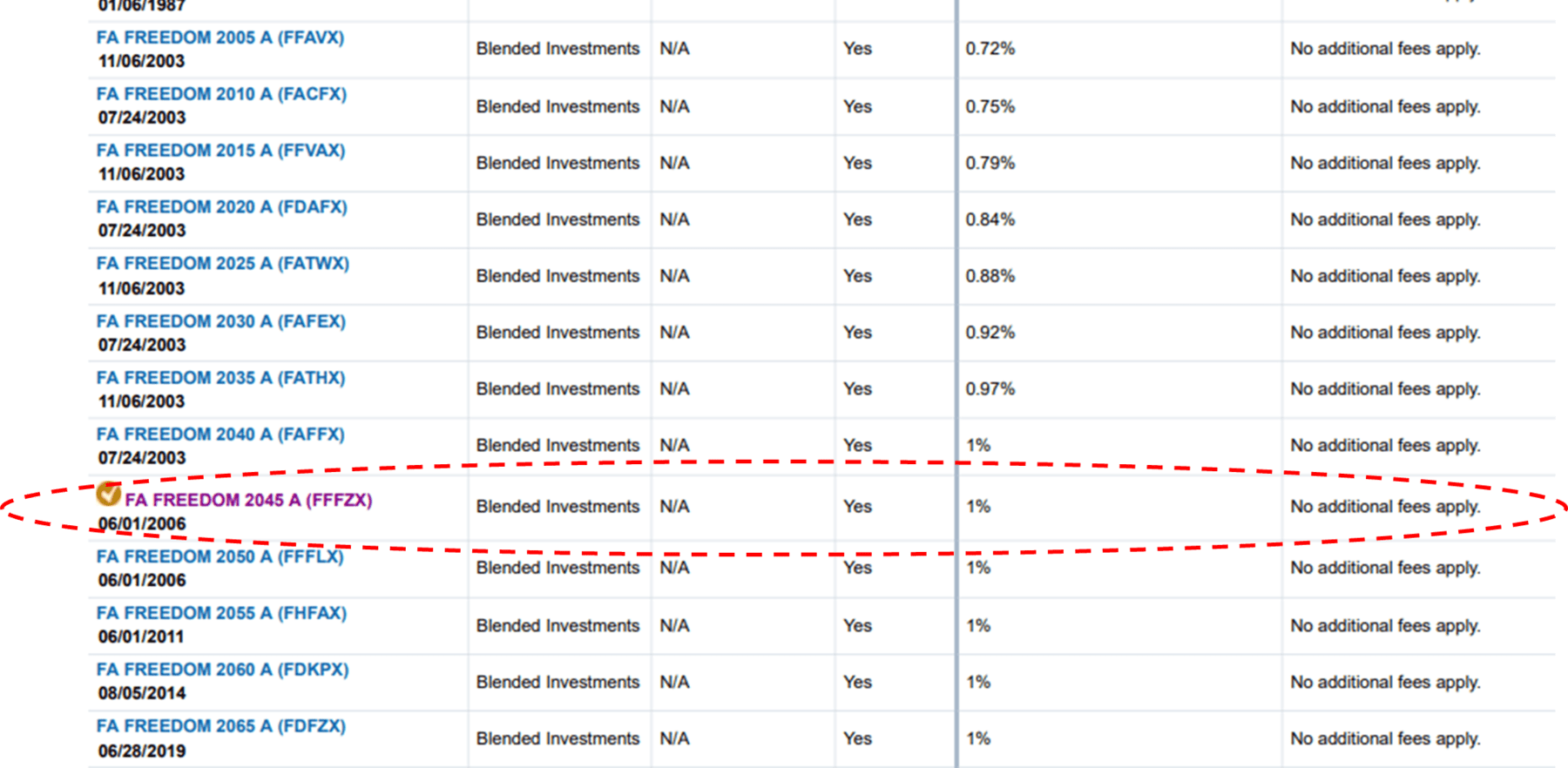

Not all share classes are the same It’s tricky, 401(k) might use target date funds with different share classes. Employers select a menu of investment options with higher expense ratios while participants unknowingly pay for the plan.

The above client was defaulted into the FA Freedom 2045 A fund. With $300,000+ in their 401(k) plan they maxed out for the last 10-years.

We reallocated his investments, saving him around $3,000 per year

(Eric note: this is not a recommendation for you, and is specific to the client, and their financial circumstances. Fees could change. Different for every client.)

Client Two: Fidelity 401(k) Plan Investment Options

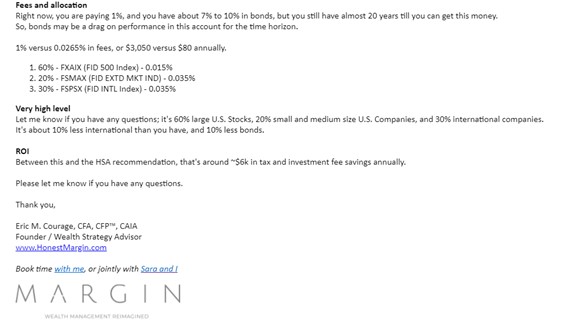

Proposed allocation saves client $6,400 in fees yearly

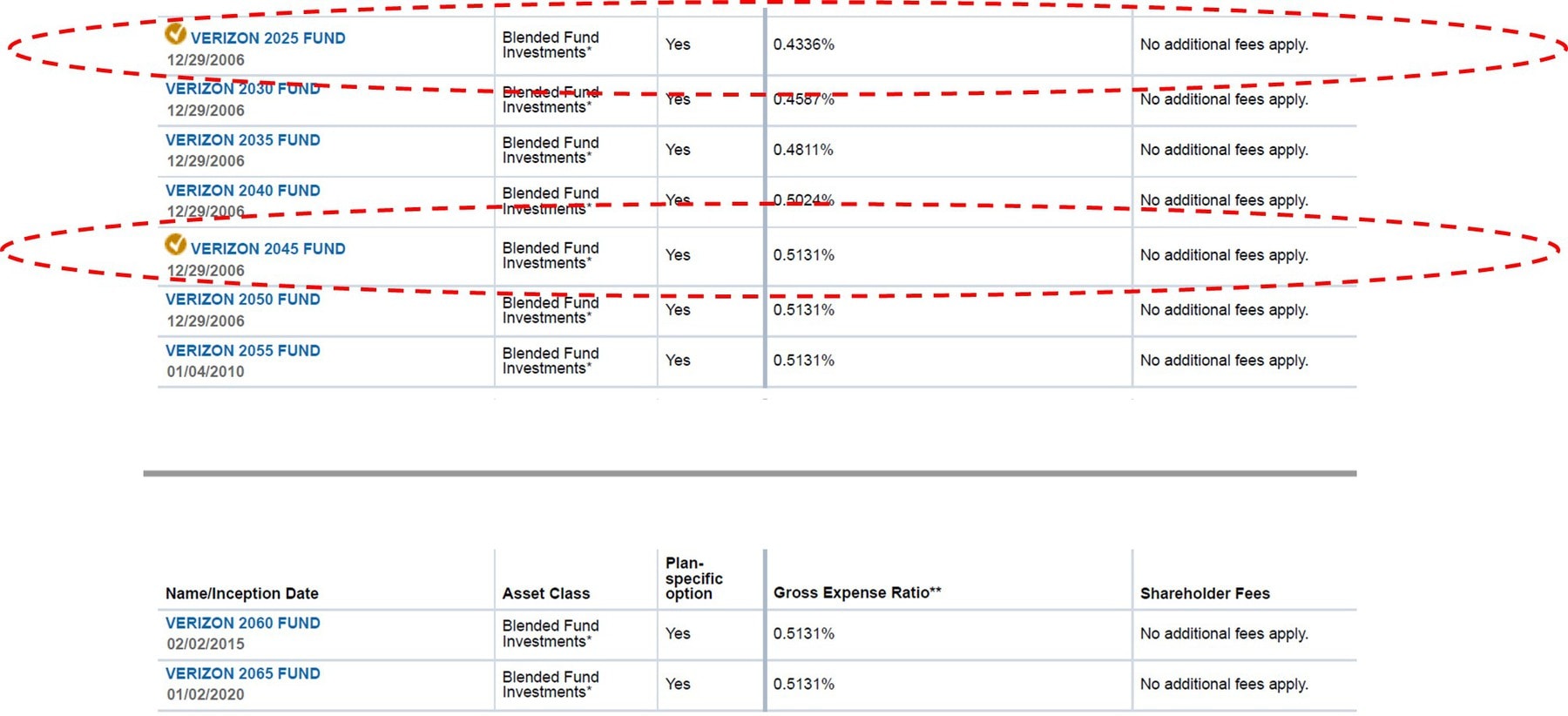

This client had $1.6M in their 401(k). Invested in target-date funds with internal fees of ~0.50% versus an allocation we recommended at 0.10% into a portfolio of index fund alternatives.

This equaled around a $6,400 per year savings in internal fees.

Target: On the Underperformance of Target-Date Funds

$1.6 trillion are invested in Target-Date Funds! Totaling 60% of all 401(k) contributions in 2019.

Brown and Davies used a $1MM portfolio example. A Fidelity Target Date Fund versus a portfolio with index funds cost an investor over $267,000 in lost returns over 13-years.

Are they worth it? Many times…No.

Default target-date investment options are convenient, rebalance during downturns, and adjust asset allocations as investors near retirement. However, they cost more, and don’t justify these benefits. In fact, not only are there greater fees, but underperformance in active management/asset allocation timing, and larger cash allocations/cash drag eat into investor returns too.

We all miss things that add up overtime

It’s not hard to reallocate out of a target date fund into a portfolio of individual index fund options. Still, many investors don’t.

Fidelity and others charge this gap in fees because it’s not transparent. There’s no statement line item. It’s a default option, so year-after-year there’s no changes, and inertia takes over.

After a while, these higher fees hide in plain sight costing hundreds of thousands of dollars in returns, over the long-term.