How Do We Work Together?

In-depth

Financial Planning

Investment Management

Tax

Strategy

Your Other Options

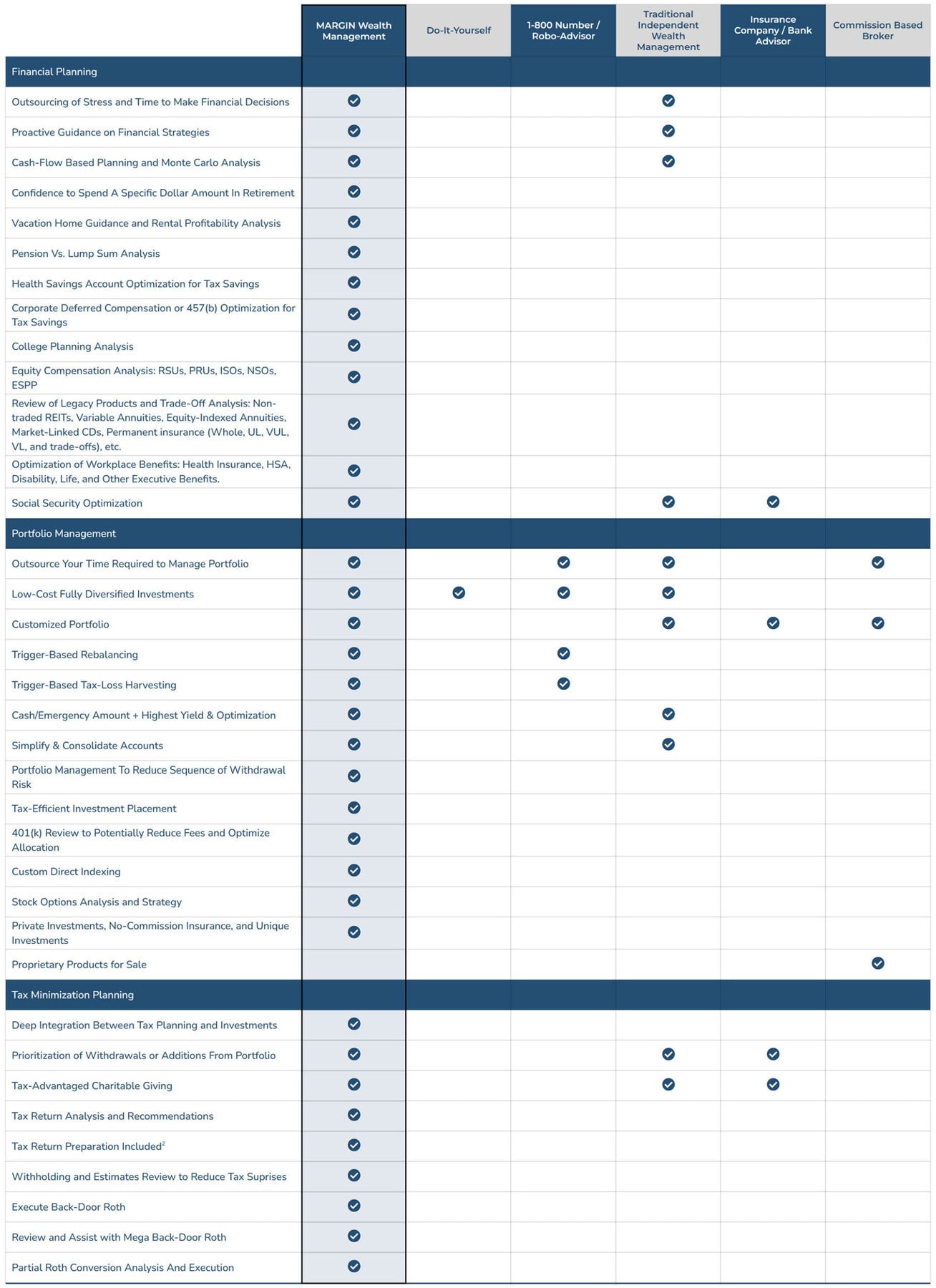

What we see typically see in the marketplace1

Financial Planning

Outsourcing of Stress and Time to Make Financial Decisions

Proactive Guidance on Financial Strategies

Cash-Flow Based Planning and Monte Carlo Analysis

Confidence to Spend A Specific Dollar Amount In Retirement

Vacation Home Guidance and Rental Profitability Analysis

Pension Vs. Lump Sum Analysis

Health Savings Account Optimization for Tax Savings

Corporate Deferred Compensation or 457(b) Optimization for Tax Savings

College Planning Analysis

Equity Compensation Analysis: RSUs, PRUs, ISOs, NSOs, ESPP

Review of Legacy Products and Trade-Off Analysis: Non-traded REITs, Variable Annuities, Equity-Indexed Annuities, Market-Linked CDs, Permanent insurance (Whole, UL, VUL, VL, and trade-offs), etc.

Optimization of Workplace Benefits: Health Insurance, HSA, Disability, Life, and Other Executive Benefits.

Social Security Optimization

Portfolio Management

Outsource Your Time Required to Manage Portfolio

Low-Cost Fully Diversified Investments

Customized Portfolio

Trigger-Based Rebalancing

Trigger-Based Tax-Loss Harvesting

Cash/Emergency Amount + Highest Yield & Optimization

Simplify & Consolidate Accounts

Portfolio Management To Reduce Sequence of Withdrawal Risk

Tax-Efficient Investment Placement

401(k) Review to Potentially Reduce Fees and Optimize Allocation

Custom Direct Indexing

Stock Options Analysis and Strategy

Private Investments, No-Commission Insurance, and Unique Investments

Proprietary Products for Sale

Tax Minimization Planning

Deep Integration Between Tax Planning and Investments

Prioritization of Withdrawals or Additions From Portfolio

Tax-Advantaged Charitable Giving

Tax Return Analysis and Recommendations

Tax Return Preparation Included2

Withholding and Estimates Review to Reduce Tax Suprises

Execute Back-Door Roth

Review and Assist with Mega Back-Door Roth

Partial Roth Conversion Analysis And Execution

MARGIN Wealth Management

Do-It-Yourself

1-800 Number / Robo-Advisor

Traditional Independent Wealth Management

Insurance Company / Bank Advisor

Commission Based Broker

Disclosures

1. Information presented believed to be factual and up-to-date, but we do not guarantee it’s accuracy and should not be regarded as complete analysis of the subjects discussed. This information should not be considered as investment advice or as a recommendation. Investors should always consult a firm’s disclosure statements before making any decisions about what is right for the investor. MARGIN, LLC (“MARGIN”) is an investment registered with the State of Colorado. Registration does not imply any level of skill or training. A copy of MARGIN’s current written disclosure statement discussing MARGIN’s business operations, services, and fees is available upon request.

2. Outsourced tax preparation availability based on level of assets managed, tax complexity, and current compacity of tax preparation.

We work best with:

We add the most amount of value when prospective on-going clients have:

Household Investable assets of $1MM+

And / Or

Household Personal Income of $500,000+

SCHEDULE YOUR CONSULTATION

Not ready to meet, but want to start planning your future? Use our tool!

We’re giving you the opportunity to utilize our industry-leading financial planning tool from the comfort of your own home. It’s the same financial planning tool that our CFP® Professionals use with our clients.