ARE WE A MUTUAL FIT?

5-STEP MUTUAL FIT PROCESS

BOOK A MUTUAL FIT MEETING

Get on our calendar. Let us know what solutions you are seeking. The more you tell us, the more we can let you know upfront if we are good fit.

VIRTUAL MEETING

Over 30 minutes let’s answer what brought you here; how a relationship works; and talk through what mutual success is.

REQUEST INFORMATION

We may request more information to answer any questions or understand your financial case better.

REVIEW & DISCUSS SOLUTIONS

Review our personalized solutions, and mutually decide if it makes sense to work together.

GET SCHEDULED...GET THINGS DONE

We will send an online on-boarding package to get started.

SCHEDULE YOUR CONSULTATION

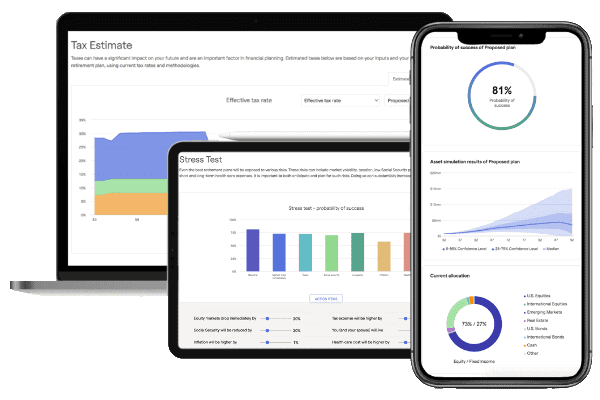

Not ready to meet, but want to start planning your future? Use our tool!

We’re giving you the opportunity to utilize our industry-leading financial planning tool from the comfort of your own home. It’s the same financial planning tool that our CFP® Professionals use with our clients.