What is socially responsible investing (“SRI”) or environmental social governance (“ESG”) investing?

Socially Responsible Investing and Environmental, Social, and Governance factors aim to make capitalism (feel) “good,” and punish companies that do “bad” things.

“Bad” sectors like alcohol, fossil fuels, fur, guns, gambling, nuclear energy, weapons, tobacco, adult, and other “sin” sectors are bad.

Oh…And Tesla too, according to S&P Global ESG/SRI ratings. (By the way, I’ve read the explanation why Tesla was removed a couple times, and it’s hard to understand what S&P is talking about!)

When the ducks are quacking…

“When the ducks start quacking, we feed them. When Main Street’s wants are great enough, Wall Street pumps out a product.”

– Franklin Templeton Wholesaler, Circa 2011

Here are four reasons to reconsider ESG/SRI investing, and what you can do differently to be a better do gooder.

1. Cost: Overpaying for ESG/SRI Peace, Love and Happiness = marketing for a higher expense ratio

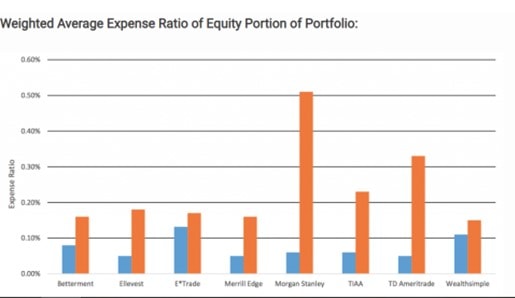

Based on this research in 2018, you are paying 0.07% to 0.24% more for these ESG/SRI portfolios. Blue is the standard, or non-ESG/SRI expense ratio, and orange is the price for the ESG/SRI portfolio.

Let’s do our own homework on the top three SRI/ESG ETF companies (as of May 17th 2022)

Top Three ETF Providers: iShares, SPDRs, and Vanguard

- iShares, average cost (g., expense ratio) for an ESG/SRI fund was 0.24%. 30 funds are in their own ESG/SRI category, or $62Bil in assets under management.

- Their lowest expense ratio ETFs are 0.03%; like their S&P 500 ETF – IVV

- SPDRs, the average cost for an ESG/SRI fund was 0.19%. 11 funds are in their own ESG/SRI category, or $2Bil in assets under management.

- Their lowest expense ratio ETFs are 0.03%; like their S&P 500 ETF – SPLG

- Vanguard, the average cost for an ESG/SRI fund was 0.11%. 2 funds are in their own ESG/SRI category, or $8.9Bil in assets under management.

- Their lowest expense ratio ETFs are 0.03%; like their S&P 500 ETF – VOO

As you can see from above, one of the fund companies, is making a market in this: Blackrock. But, does it really cost them 8Xs the cost to manage this fund versus another ETF?

Many potential client portfolios from Robo(t)-Advisor Betterment come to our firm in these SRI/ESG portfolios full of these funds that have higher expense ratios.

What’s the difference really cost?

It’s only a small difference in cost, right? On a million dollars, how much does a 0.21% difference really add to? Or, the cost between Blackrock’s S&P 500 index fund and their average ESG/SRI fund expense add up to over 5 years?

$10,545.

You most likely know of a better philanthropic cause than making more money for Blackrock shareholders trying to convince you they are doing good…

When there is a big enough demand from main street, regardless of if it’s a good investment idea, if it can be sold, Wall Street sells it…

“There’s three ways to get paid…

1. Lie to people who want to be lied to, and you’ll get rich.

2. Tell the truth to those who want the truth, and you’ll make a living.

3. Tell the truth to those who want to be lied to, and you’ll go broke.”

– Jason Zweig, Wall Street Journal

2. Subjectivity: Feed the children, and kill the whales, or save the whales, and let the children starve?

It’s not a clean-cut science. Does overweighting Apple versus Exxon Mobil make a tangible difference in making the world a better place? Of course, you say, we are trading less fossil fuel production for technology…But…

What about human slavery? Certainly, ending this is an important factor to making the world a better place.

Remember, Apple’s suicide of workers in China? Factory workers jumped off the roof to protest poor conditions. I’m sure they’d never ever use that company again, right?!

I’m picking on Apple, because many people would view them as a hero versus Exxon Mobile, or Tesla…Who just got cut from S&P Global’s ESG/SRI index…But why?

These ratings are subjective. Yes, they make you feel great on the surface. But, there’s a trade-off in every reason to include or exclude a company based on how “good” they are.

The SEC is even having a hard time understanding the criteria. Even prompting a speech on this very issue. New regulations on this are coming soon.

3. Unknown Portfolio Tilts: (Usually) more technology, less oil and gas, and more interest rate sensitive sectors

There’s a portfolio case of why you should not own ESG or SRI investments: you don’t know what you own.

Many times, investors unknowingly take active portfolio risks to do good. How?

Historically, there’s research from the past that states ESG/SRI factors help returns. But, maybe this is because the Nasdaq or technology overweight has helped these portfolios.

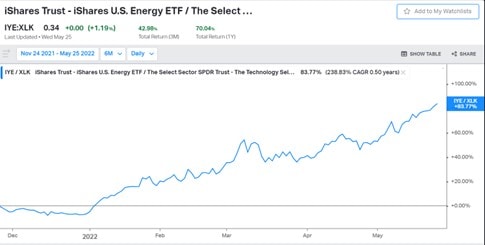

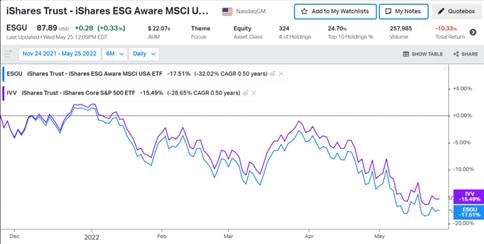

So, let’s take these last 6 months as interest rates have spiked, and the technology sector has declined greater than broader markets.

Over the last 5-years, it’s been hard to see BlackRock’s largest ESG fund, ESGU performing much different than IVV.

But, let’s look at the last 6 months. Before that, first let’s look at Technology versus energy

With the conflict in Ukraine and Russia, shortages in diesel, and inflation concerns, energy is up over 80% versus technology. This is a sector mismatch; with a 2% spread in returns between a S&P 500 and ESG/SRI S&P 500 fund even though the complete holdings are very similar.

4. Better alternatives: Donor-Advised Funds – How to truly make a difference instead of just paying someone more to think you are.

Donor-advised funds are a way to save on taxes, and get money to a 501(c)(3). Where you can put a large chunk of cash into one of these funds, get the up-front tax deduction, and then decide over time where you’d like the money to be spent. You have control and direct impact.

Or, you could just directly contribute to a cause you believe in between the difference in your portfolio and an ESG/SRI portfolio cost. Studies also show investing into ESG/SRI investments actually reduces the total amount of charitable giving too.

In the end, ESG/SRI investing makes it hard to invest with our individual beliefs or values, we end up paying too much, and have a portfolio we really don’t know what it’s invested into.